Multiple Choice

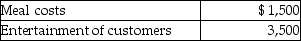

Steven is a representative for a textbook publishing company.Steven attends a convention which will also be attended by many potential customers.During the week of the convention,Steven incurs the following costs in entertaining potential customers.  Having recently been to a company seminar on tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the meetings with customers.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Having recently been to a company seminar on tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the meetings with customers.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

A) $500 from AGI

B) $500 for AGI

C) $2,000 from AGI

D) $2,000 for AGI

Correct Answer:

Verified

Correct Answer:

Verified

Q9: All taxpayers are allowed to contribute funds

Q63: A nondeductible floor of 2% of AGI

Q72: Mirasol Corporation granted an incentive stock option

Q82: Jason,who lives in New Jersey,owns several apartment

Q125: Feng,a single 40 year old lawyer,is covered

Q126: Rajiv,a self-employed consultant,drove his auto 20,000 miles

Q131: If the purpose of a trip is

Q133: An employer-employee relationship exists where the employer

Q147: Allison,who is single,incurred $4,000 for unreimbursed employee

Q1643: Johanna is single and self- employed as