Multiple Choice

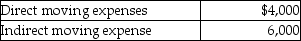

Edward incurs the following moving expenses:  The employer reimburses Edward for the full $10,000.What is the amount to be reported as income by Edward?

The employer reimburses Edward for the full $10,000.What is the amount to be reported as income by Edward?

A) $0

B) $4,000

C) $6,000

D) $10,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q18: Which of the following is true about

Q22: A taxpayer moves for employment in November

Q23: Josiah is a human resources manager of

Q31: Which of the following is true about

Q41: Gambling losses are miscellaneous itemized deductions subject

Q82: Which of the following statements regarding Health

Q86: Taxpayers may use the standard mileage rate

Q105: Assuming AGI below the threshold,a contributor may

Q116: Ron is a university professor who accepts

Q641: If an employee incurs travel expenditures and