Multiple Choice

Martin Corporation granted a nonqualified stock option to employee Caroline on January 1,2012.The option price was $150,and the FMV of the Martin stock was also $150 on the grant date.The option allowed Caroline to purchase 1,000 shares of Martin stock.The option itself does not have a readily ascertainable FMV.Caroline exercised the option on August 1,2015 when the stock's FMV was $250.If Caroline sells the stock on September 5,2016 for $300 per share,she must recognize

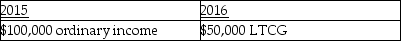

A)

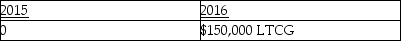

B)

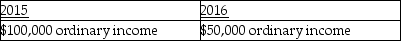

C)

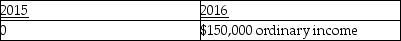

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q38: Deductible moving expenses include the cost of

Q56: Transportation expenses incurred to travel from one

Q67: Charles is a self-employed CPA who maintains

Q77: Travel expenses related to temporary work assignments

Q78: Tyler (age 50)and Connie (age 48)are a

Q80: Which of the following statements is incorrect

Q89: Rui is a CPA is employed by

Q94: In a contributory defined contribution pension plan,all

Q859: An employer adopts a per diem policy

Q1239: Fiona is about to graduate college with