Multiple Choice

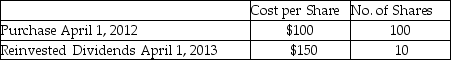

Rachel holds 110 shares of Argon Mutual Fund.She is planning to sell 90 shares.Her record of the share purchases is noted below.What could be her basis for the 90 shares to be sold for purposes of determining gain?

A) $9,000

B) $9,500

C) $9,409

D) Any of the above could be used as basis for the 90 shares sold.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Taxpayers who own mutual funds recognize their

Q32: Jamahl and Indira are married and live

Q77: In a basket purchase,the total cost is

Q80: Kathleen received land as a gift from

Q90: Capitalization of interest is required if debt

Q91: Generally,gains resulting from the sale of collectibles

Q95: In 2006,Regina purchased a home in Las

Q96: Stock purchased on December 15,2014,which becomes worthless

Q104: The holding period of property received from

Q1861: Donald has retired from his job as