Multiple Choice

Dustin purchased 50 shares of Short Corporation for $500.During the current year,Short declared a nontaxable 10% stock dividend.What is the basis per share before and after the stock dividend is distributed?

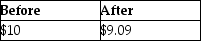

A)

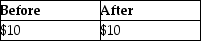

B)

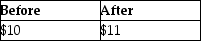

C)

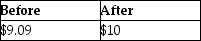

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q18: All recognized gains and losses must eventually

Q34: Everest Inc.is a corporation in the 35%

Q66: Adjusted net capital gain is taxed at

Q71: Dennis purchased a machine for use in

Q72: When a taxpayer has NSTCL and NLTCG,the

Q74: A taxpayer owns 200 shares of stock

Q76: Because of the locked-in effect,high capital gains

Q85: All realized gains and losses are recognized

Q106: Courtney sells a cottage at the lake

Q130: Net long-term capital gains receive preferential tax