Essay

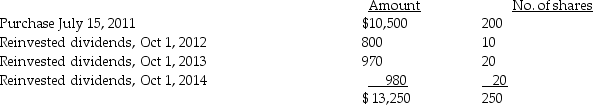

Joy purchased 200 shares of HiLo Mutual Fund on July 15,2011,for $10,500,and has been reinvesting dividends.On December 15,2015,she sells 100 shares.  What is the basis for the shares sold assuming (1)FIFO and (2)average cost method?

What is the basis for the shares sold assuming (1)FIFO and (2)average cost method?

Correct Answer:

Verified

Assuming FIFO,the basis in the...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: Which one of the following does not

Q28: Antonio is single and has taxable income

Q33: In 2011 Toni purchased 100 shares of

Q34: Trista,a taxpayer in the 33% marginal tax

Q56: Will exchanges a building with a basis

Q73: Empire Corporation purchased an office building for

Q106: An uncle gifts a parcel of land

Q119: Melody inherited 1,000 shares of Corporation Zappa

Q124: Expenditures which do not add to the

Q129: Emma Grace acquires three machines for $80,000,which