Multiple Choice

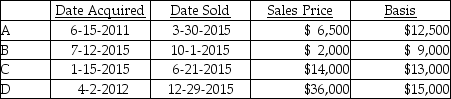

Coretta sold the following securities during 2015:  What is Coretta's net capital gain or loss result for the year?

What is Coretta's net capital gain or loss result for the year?

A) NSTCL of $3,000 and NLTCG of $15,000

B) $9,000 ANCG

C) $0

D) $12,000 ANCG

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q18: All recognized gains and losses must eventually

Q29: Which one of the following is a

Q47: Allison buys equipment and pays cash of

Q53: If Houston Printing Co.purchases a new printing

Q66: Adjusted net capital gain is taxed at

Q71: Terrell and Michelle are married and living

Q76: Because of the locked-in effect,high capital gains

Q90: In a common law state,jointly owned property

Q106: Courtney sells a cottage at the lake

Q2127: Distinguish between the Corn Products doctrine and