Multiple Choice

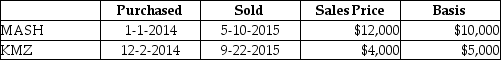

Nate sold two securities in 2015:  Nate has a 25% marginal tax rate.What is the additional tax resulting from the above sales?

Nate has a 25% marginal tax rate.What is the additional tax resulting from the above sales?

A) $150

B) $200

C) $300

D) $400

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q13: Kendrick,who has a 33% marginal tax rate,had

Q14: Sari is single and has taxable income

Q17: On July 25,2014,Marilyn gives stock with a

Q35: If a nontaxable stock dividend is received

Q52: Candice owns a mutual fund that reinvests

Q69: A nonbusiness bad debt is deductible only

Q84: David gave property with a basis of

Q87: Michelle purchased her home for $150,000,and subsequently

Q95: Armanti received a football championship ring in

Q131: A taxpayer purchased an asset for $50,000