Multiple Choice

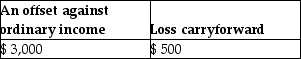

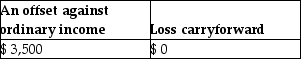

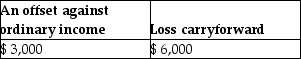

Gertie has a NSTCL of $9,000 and a NLTCG of $5,500 during the current taxable year.After gains and losses are offset,Gertie reports

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: Sanjay is single and has taxable income

Q6: Edward purchased stock last year as follows:

Q20: Billy and Sue are married and live

Q35: If a nontaxable stock dividend is received

Q45: During the current year,Don's aunt Natalie gave

Q52: Candice owns a mutual fund that reinvests

Q107: Bad debt losses from nonbusiness debts are

Q128: Normally,a security dealer reports ordinary income on

Q135: Corporate taxpayers may offset capital losses only

Q136: Stella has two transactions involving the sale