Multiple Choice

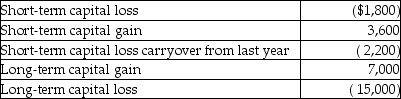

During the current year,Nancy had the following transactions:  What is the amount of her capital loss deduction for the current year,and what is the amount and character of her capital loss carryover?

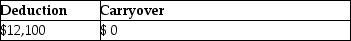

What is the amount of her capital loss deduction for the current year,and what is the amount and character of her capital loss carryover?

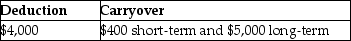

A)

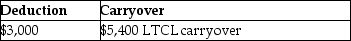

B)

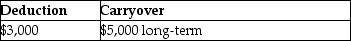

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q10: For purposes of calculating depreciation,property converted from

Q16: Taxpayers who own mutual funds recognize their

Q32: Jamahl and Indira are married and live

Q81: Jordan paid $30,000 for equipment two years

Q95: In 2006,Regina purchased a home in Las

Q96: Stock purchased on December 15,2014,which becomes worthless

Q100: If stock sold or exchanged is not

Q102: During the current year,Tony purchased new car

Q103: If the taxpayer's net long-term capital losses

Q104: The holding period of property received from