Essay

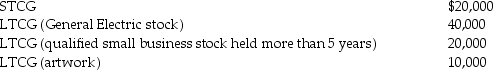

Tina,whose marginal tax rate is 33%,has the following capital gains this year:  What is the increase in income tax caused by these items (ignore the Medicare tax on net investment income)?

What is the increase in income tax caused by these items (ignore the Medicare tax on net investment income)?

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: A taxpayer reports capital gains and losses

Q5: Olivia,a single taxpayer,has AGI of $280,000 which

Q15: The taxable portion of a gain from

Q28: On January 31 of this year,Jennifer pays

Q41: Douglas and Julie are a married couple

Q43: Rita,who has marginal tax rate of 39.6%,is

Q66: Melanie,a single taxpayer,has AGI of $220,000 which

Q112: Section 1221 of the Code includes a

Q121: Joycelyn gave a diamond necklace to her

Q122: With regard to taxable gifts after 1976,no