Essay

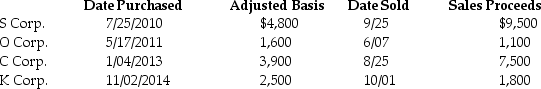

Mike sold the following shares of stock in 2015:  What are the tax consequences of these transactions,assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

What are the tax consequences of these transactions,assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q9: Which one of the following does not

Q21: Mike,a dealer in securities and calendar-year taxpayer,purchased

Q28: Antonio is single and has taxable income

Q69: A nonbusiness bad debt is deductible only

Q73: Empire Corporation purchased an office building for

Q87: Michelle purchased her home for $150,000,and subsequently

Q119: Melody inherited 1,000 shares of Corporation Zappa

Q124: Expenditures which do not add to the

Q131: A taxpayer purchased an asset for $50,000

Q751: What type of property should be transferred