Essay

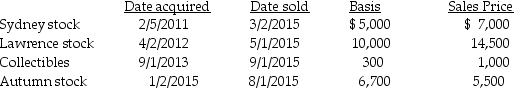

Chen had the following capital asset transactions during 2015:  What is the adjusted net capital gain or loss and the related tax due to the above transactions,assuming Chen has a 25% marginal tax rate?

What is the adjusted net capital gain or loss and the related tax due to the above transactions,assuming Chen has a 25% marginal tax rate?

Correct Answer:

Verified

Long-term  Short-ter...

Short-ter...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: On January 31 of the current year,Sophia

Q29: Amanda,whose tax rate is 33%,has NSTCL of

Q38: All of the following are capital assets

Q42: Brad owns 100 shares of AAA Corporation

Q70: Kate subdivides land held as an investment

Q92: Dale gave property with a basis of

Q102: Gains and losses are recognized when property

Q130: This year,Lauren sold several shares of stock

Q132: Darla sold an antique clock in 2015

Q134: Topaz Corporation had the following income and