Essay

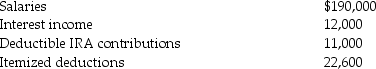

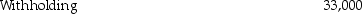

The following information is available for Bob and Brenda Horton,a married couple filing a joint return,for 2015.Both Bob and Brenda are age 32 and have no dependents.

a.What is the amount of their gross income?

a.What is the amount of their gross income?

b.What is the amount of their adjusted gross income?

c.What is the amount of their taxable income?

d.What is the amount of their tax liability (gross tax)?

e.What is the amount of their tax due or (refund due)?

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Refundable tax credits are allowed to reduce

Q15: If a 13-year-old has earned income of

Q61: Juanita's mother lives with her.Juanita purchased clothing

Q72: A taxpayer can receive innocent spouse relief

Q108: To qualify as an abandoned spouse,the taxpayer

Q129: In October 2014,Joy and Paul separated and

Q133: Tax returns from individual and corporate taxpayers

Q134: For 2015,unearned income in excess of $2,100

Q137: Charlie is claimed as a dependent on

Q929: Oscar and Diane separated in June of