Multiple Choice

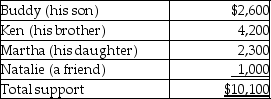

Blaine Greer lives alone.His support comes from the following sources:  Assuming a multiple support declaration exists,which of the individuals may claim Blaine as a dependent?

Assuming a multiple support declaration exists,which of the individuals may claim Blaine as a dependent?

A) Ken or Martha

B) Buddy,Ken,or Martha

C) Ken,Martha,or Natalie

D) None of them

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Generally,in the case of a divorced couple,the

Q28: A legally married same-sex couple can file

Q31: Generally,deductions for (not from)adjusted gross income are

Q34: Keith,age 17,is a dependent of his parents.During

Q39: Paul and Hannah,who are married and file

Q40: Lewis,who is single,is claimed as a dependent

Q46: Although exclusions are usually not reported on

Q67: Form 4868,a six-month extension of time to

Q111: Taxable income for an individual is defined

Q145: Amanda has two dependent children,ages 10 and