Essay

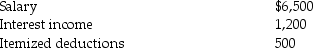

The following information for 2015 relates to Emma Grace,a single taxpayer,age 18:  a.Compute Emma Grace's taxable income assuming she is self-supporting.

a.Compute Emma Grace's taxable income assuming she is self-supporting.

b.Compute Emma Grace's taxable income assuming she is a dependent of her parents.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: A building used in a business is

Q5: Rob is a taxpayer in the top

Q21: If an individual with a marginal tax

Q41: The oldest age at which the "Kiddie

Q72: If an individual with a marginal tax

Q77: Charishma is a taxpayer with taxable income

Q81: Indicate for each of the following the

Q84: Michelle,age 20,is a full-time college student with

Q90: Suri,age 8,is a dependent of her parents

Q95: The child credit is for taxpayers with