Essay

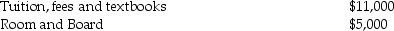

Tom and Anita are married,file a joint return with an AGI of $165,000,and have one dependent child,Tim,who is a first-time freshman in college.The following expenses are incurred and paid in 2015:  What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Correct Answer:

Verified

Tim is eligible for the American Opportu...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: In the fall of 2015,James went back

Q16: A self-employed individual has earnings from his

Q19: Mark and Stacy are married,file a joint

Q36: ChocoHealth Inc.is developing new chocolate products providing

Q43: Rex has the following AMT adjustment factors:

Q50: An individual with AGI equal to or

Q63: For purposes of the AMT,only the foreign

Q107: Which of the following expenditures will qualify

Q114: The general business credit may not exceed

Q126: Octo Corp.purchases a building for use in