Multiple Choice

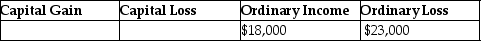

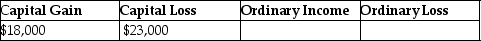

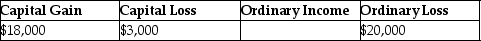

Jeremy has $18,000 of Section 1231 gains and $23,000 of Section 1231 losses.The gains and losses are characterized as

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: Aamir has $25,000 of net Sec.1231 gains

Q8: Echo Corporation plans to sell a small

Q12: Cobra Inc.sold stock for a $25,000 loss

Q15: Connors Corporation sold a warehouse during the

Q26: Terry has sold equipment used in her

Q31: Jillian,whose tax rate is 39.6%,had the following

Q33: If realized gain from disposition of business

Q36: During the current year,Kayla recognizes a $40,000

Q58: Unrecaptured 1250 gain is the amount of

Q63: Which of the following assets is 1231