Multiple Choice

Daniel recognizes $35,000 of Sec.1231 gains and $25,000 of Sec.1231 losses during the current year.The only other Sec.1231 item was a $4,000 loss three years ago.This year,Daniel must report

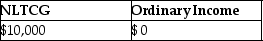

A)

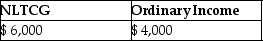

B)

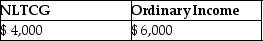

C)

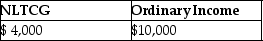

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q7: All of the following are considered related

Q21: If Section 1231 applies to the sale

Q31: Jillian,whose tax rate is 39.6%,had the following

Q35: Network Corporation purchased $200,000 of five-year equipment

Q39: Jesse installed solar panels in front of

Q79: The amount recaptured as ordinary income under

Q81: For a business,Sec.1231 property does not include<br>A)timber,coal,or

Q84: When a donee disposes of appreciated gift

Q85: The sale of inventory results in ordinary

Q111: Jacqueline dies while owning a building with