Multiple Choice

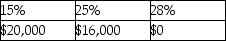

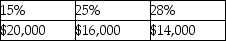

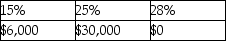

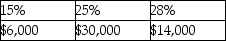

Yelenis,whose tax rate is 28%,sells one Sec.1231 asset this year,resulting in a $50,000 gain.Included in the $50,000 Sec.1231 gain is $30,000 of unrecaptured Sec.1250 gain.A review of Yelenis tax files for the past five years indicates one prior Sec.1231 sale which resulted in a $14,000 loss.The gain will be taxed as

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q6: A corporation owns many acres of timber,which

Q8: Echo Corporation plans to sell a small

Q12: Cobra Inc.sold stock for a $25,000 loss

Q15: Connors Corporation sold a warehouse during the

Q25: Ross purchased a building in 1985,which he

Q28: With respect to residential rental property<br>A)80% or

Q36: During the current year,Kayla recognizes a $40,000

Q58: Unrecaptured 1250 gain is the amount of

Q70: For noncorporate taxpayers,depreciation recapture is not required

Q105: All of the following statements are true