Multiple Choice

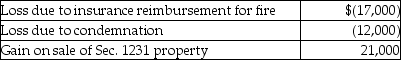

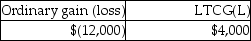

This year Jenna had the gains and losses noted below on property,plant and equipment used in her business.Each asset had been held longer than one year.Jenna has not previously disposed of any business assets.  Jenna will recognize

Jenna will recognize

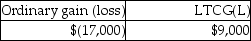

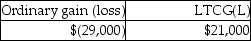

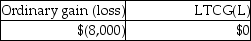

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Emily,whose tax rate is 28%,owns an office

Q27: When appreciated property is transferred at death,the

Q35: With regard to noncorporate taxpayers,all of the

Q40: During the current year,a corporation sells equipment

Q42: WAM Corporation sold a warehouse during the

Q55: Sec.1250 requires a portion of gain realized

Q57: The following are gains and losses recognized

Q59: Julie sells her manufacturing plant and land

Q86: Pierce has a $16,000 Section 1231 loss,a

Q91: Indicate whether each of the following assets