Multiple Choice

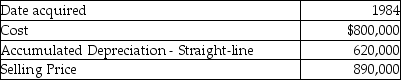

A corporation sold a warehouse during the current year.The straight-line depreciation method was used.Information about the building is presented below:  How much gain should the corporation report as section 1231 gain?

How much gain should the corporation report as section 1231 gain?

A) $124,000

B) $620,000

C) $586,000

D) $710,000

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Mark owns an unincorporated business and has

Q26: A building used in a business for

Q31: Gains and losses from involuntary conversions of

Q66: Section 1250 does not apply to assets

Q69: Jaiyoun sells Sec.1231 property this year,resulting in

Q77: The purpose of Sec.1245 is to eliminate

Q86: Jed sells an office building during the

Q93: The following gains and losses pertain to

Q93: Sec.1245 applies to gains on the sale

Q101: Harry owns equipment ($50,000 basis and $38,000