Essay

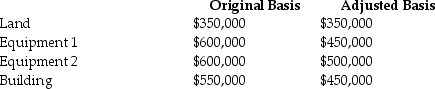

Describe the tax treatment for a noncorporate taxpayer in the 39.6% marginal tax bracket who sells each of the first two assets for $500,000 and each of the second two assets for $750,000.Each asset was purchased in 2011 and is used in a trade or business.There are no other gains and losses and no nonrecaptured Section 1231 losses.

Correct Answer:

Verified

• Land: $150,000 Section 1231 gain taxed...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: A corporation owns many acres of timber,which

Q16: Trena LLC,a tax partnership owned equally by

Q22: Mark owns an unincorporated business and has

Q46: A taxpayer purchased a factory building in

Q55: In addition to the normal recapture rules

Q66: Section 1250 does not apply to assets

Q68: If the accumulated depreciation on business equipment

Q82: Sec.1245 ordinary income recapture can apply to

Q93: Sec.1245 applies to gains on the sale

Q100: For livestock to be considered Section 1231