Multiple Choice

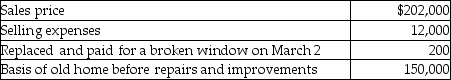

Frank,a single person age 52,sold his home this year.He had lived in the house for 10 years. He signed a contract on March 4 to sell his home and closed the sale on May 3.  Based on these facts,what is the amount of his recognized gain?

Based on these facts,what is the amount of his recognized gain?

A) $0

B) $39,800

C) $40,000

D) $52,000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Bobbie exchanges business equipment (adjusted basis $160,000)for

Q3: Each of the following is true of

Q30: Stephanie's building,which was used in her business,was

Q45: Which of the following statements is false

Q49: Which of the following statements is false

Q67: Eric exchanges a printing press with an

Q90: James and Ellen Connors,who are both 50

Q98: Theresa owns a yacht that is held

Q99: Vector Inc.'s office building burns down on

Q118: An investor in artwork holds a Picasso