Multiple Choice

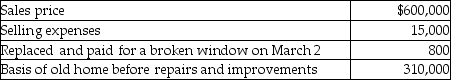

Pierce,a single person age 60,sold his home this year.He had lived in the house for 10 years.He signed a contract on March 4 to sell his home.  Based on these facts,what is the amount of his recognized gain?

Based on these facts,what is the amount of his recognized gain?

A) $0

B) $25,000

C) $40,000

D) $275,000

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Generally,a full exclusion of gain under Sec.121

Q33: The building used in Tim's business was

Q35: If property is involuntarily converted into similar

Q38: Pamela owns land for investment purposes.The land

Q45: Which of the following statements is false

Q53: The receipt of boot as part of

Q56: For purposes of nontaxable exchanges,cash and non-like-kind

Q90: James and Ellen Connors,who are both 50

Q99: Cheryl owns 200 shares of Cornerstone Corporation

Q327: Ike and Tina married and moved into