Multiple Choice

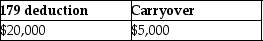

Cate purchases and places in service property costing $150,000 in 2015.She wants to elect the maximum Sec.179 deduction allowed.Her business income is $20,000.What is the amount of her allowable Sec.179 deduction and carryover,if any?

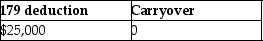

A)

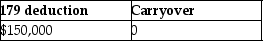

B)

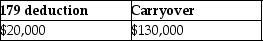

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q28: The Section 179 expensing election is available

Q41: Costs that qualify as research and experimental

Q50: Under the MACRS system,automobiles and computers are

Q66: In July of 2015,Pat acquired a new

Q68: On January 3,2012,John acquired and placed into

Q72: In May 2015,Cassie acquired a machine for

Q73: Galaxy Corporation purchases specialty software from a

Q74: On May 1,2012,Empire Properties Corp.,a calendar year

Q76: Expenditures that enlarge a building,any elevator or

Q76: On November 3,this year,Kerry acquired and placed