Essay

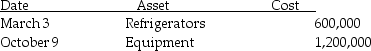

During the year 2015,a calendar year taxpayer,Marvelous Munchies,a chain of specialty food shops,purchased equipment as follows:  Assume the property is all 5-year property.What is the maximum depreciation that may be deducted for the assets this year,2015,assuming the alternative depreciation system is not chosen?

Assume the property is all 5-year property.What is the maximum depreciation that may be deducted for the assets this year,2015,assuming the alternative depreciation system is not chosen?

Correct Answer:

Verified

The mid-quarter convention mus...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: In order for an asset to be

Q27: A taxpayer owns an economic interest in

Q45: Under the MACRS system,if the aggregate basis

Q47: In January of 2015,Brett purchased a Porsche

Q47: Taxpayers are entitled to a depletion deduction

Q51: Tessa owns an unincorporated manufacturing business.In 2015,she

Q82: In the current year George,a college professor,acquired

Q83: If personal-use property is converted to trade

Q85: Off-the-shelf computer software that is purchased for

Q1085: Jack purchases land which he plans on