Essay

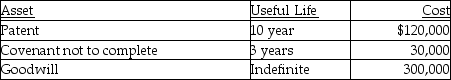

Stellar Corporation purchased all of the assets of Bellavia Company as of January 1 this year for $1 million.Included in the assets acquired are the following intangible assets:  What is Stellar's maximum amortization deduction for the year?

What is Stellar's maximum amortization deduction for the year?

Correct Answer:

Verified

The assets are Sec.197 acquisi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: Intangible assets are subject to MACRS depreciation.

Q19: Eric is a self-employed consultant.In May of

Q23: Prithi acquired and placed in service $190,000

Q24: Ilene owns an unincorporated manufacturing business.In 2015,she

Q31: The mid-quarter convention applies to personal and

Q45: Any Section 179 deduction that is not

Q53: Under what circumstances might a taxpayer elect

Q62: Which of the following statements regarding Sec.179

Q63: Jimmy acquires an oil and gas property

Q70: Intangible drilling and development costs (IDCs)may be