Essay

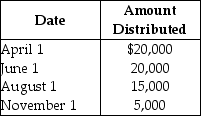

Payment Corporation has accumulated E&P of $19,000 and current E&P of $28,000.During the year,the corporation makes the following distributions to its sole shareholder:  The sole shareholder's basis in her stock is $45,000.What are the tax consequences of the June 1 distribution?

The sole shareholder's basis in her stock is $45,000.What are the tax consequences of the June 1 distribution?

Correct Answer:

Verified

The current E&P is allocated ratably to ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: Strong Corporation is owned by a group

Q46: Bruce receives 20 stock rights in a

Q53: Circle Corporation has 1,000 shares of common

Q55: Tia receives a $15,000 cash distribution from

Q62: Corporations may always use retained earnings as

Q67: Gould Corporation distributes land (a capital asset)worth

Q71: Maple Corporation distributes land to a noncorporate

Q76: An individual shareholder owns 3,000 shares of

Q105: Two corporations are considered to be brother-sister

Q110: Green Corporation is a calendar-year taxpayer.All of