Multiple Choice

Perch Corporation has made paint and paint brushes for the past ten years.Perch Corporation is owned equally by Arnold,an individual,and Acorn Corporation.Perch Corporation has $100,000 of accumulated and current E&P.Both Arnold and Acorn Corporation have a basis in their stock of $10,000.Perch Corporation discontinues the paint brush operation and distributes assets worth $10,000 each to Arnold and Acorn Corporation in redemption of 20% of their stock.Due to the distribution,Arnold and Acorn Corporation must report:

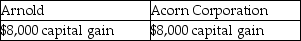

A)

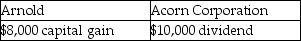

B)

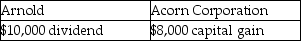

C)

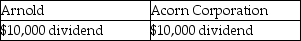

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q15: What must be reported to the IRS

Q20: A corporation distributes land and the related

Q25: White Corporation is a calendar-year taxpayer. Wilhelmina

Q28: Van owns all 1,000 shares of Valley

Q58: Identify which of the following statements is

Q68: Ameriparent Corporation owns a 70% interest in

Q88: River Corporation's taxable income is $25,000, after

Q94: Identify which of the following statements is

Q103: Identify which of the following increases Earnings

Q112: Which of the following is not a