Multiple Choice

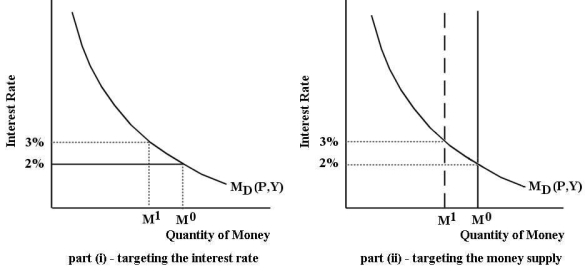

The diagrams below illustrate two alternative approaches to implementing monetary policy.The economy begins in monetary equilibrium with the interest rate equal to 2% and the money supply equal to  .

.  FIGURE 28-1 Refer to Figure 28-1.The Bank of Canada must be able to easily communicate its monetary policy actions to the public.Which approach is more amenable to this requirement,and why?

FIGURE 28-1 Refer to Figure 28-1.The Bank of Canada must be able to easily communicate its monetary policy actions to the public.Which approach is more amenable to this requirement,and why?

A) Part (ii) - targeting the money supply: because an announcement of a 1% decrease in the money supply is more easily understood than an increase in the interest rate.

B) Part (i) - targeting the interest rate: because the Bank of Canada can more easily instruct the commercial banks to raise their interest rates.

C) Part (ii) - targeting the money supply: because the public can more easily understand that a decrease in reserves in the banking system makes it more difficult to get a loan or mortgage.

D) Part (i) - targeting the interest rate: because changes in the interest rate are much more meaningful and understandable to the public than changes in the money supply.

Correct Answer:

Verified

Correct Answer:

Verified

Q71: The interest rate that commercial banks charge

Q72: Most central banks in the developed countries

Q73: Consider a central bank that chooses to

Q74: As of 2018,the Bank of Canada's policy

Q75: Most economists now accept the proposition that<br>A)an

Q77: Which of the following describes the cause

Q78: The Bank of Canada initially implements an

Q79: Time lags in the conduct of monetary

Q80: Many central banks have established formal targets

Q81: Why is high and uncertain inflation damaging