Multiple Choice

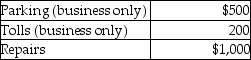

Brittany, who is an employee, drove her automobile a total of 20,000 business miles in 2014. This represents about 75% of the auto's use. She has receipts as follows:  Brittany's AGI for the year of $50,000, and her employer does not provide any reimbursement. She uses the standard mileage rate method. After application of any relevant floors or other limitations, Brittany can deduct

Brittany's AGI for the year of $50,000, and her employer does not provide any reimbursement. She uses the standard mileage rate method. After application of any relevant floors or other limitations, Brittany can deduct

A) $10,900.

B) $11,900.

C) $10,750.

D) $12,900.

Correct Answer:

Verified

Correct Answer:

Verified

Q29: Which of the following statements is incorrect

Q32: Alex is a self-employed dentist who operates

Q86: In addition to the general requirements for

Q89: Dues paid to social or athletic clubs

Q91: Incremental expenses of an additional night's lodging

Q104: A gift from an employee to his

Q117: Norman traveled to San Francisco for four

Q146: Sarah incurred employee business expenses of $5,000

Q590: When are home- office expenses deductible?

Q1888: Deferred compensation refers to methods of compensating