Multiple Choice

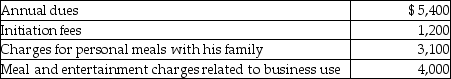

Joe is a self-employed tax attorney who frequently entertains his clients at his country club. Joe's club expenses include the following:  Assuming the business meals and entertainment qualify as deductible entertainment expenses, Joe may deduct

Assuming the business meals and entertainment qualify as deductible entertainment expenses, Joe may deduct

A) $2,000.

B) $4,700.

C) $5,300.

D) $4,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Dighi, an artist, uses a room in

Q33: If an individual is self-employed,business-related expenses are

Q42: Travel expenses for a taxpayer's spouse are

Q51: Frank is a self-employed CPA whose 2014

Q53: Which of the following statements regarding independent

Q64: All of the following characteristics are true

Q72: If the standard mileage rate is used

Q148: Generally,50% of the cost of business gifts

Q150: Travel expenses related to foreign conventions are

Q190: Why did Congress establish Health Savings Accounts