Essay

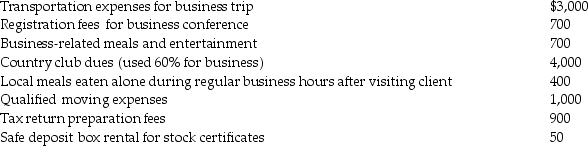

Rita, a single employee with AGI of $100,000 before consideration of the items below, incurred the following expenses during the year, all of which were unreimbursed unless otherwise indicated:

In addition, Rita paid $300 for dues to her professional business association. The company reimbursed her after she submitted the appropriate documentation. What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

In addition, Rita paid $300 for dues to her professional business association. The company reimbursed her after she submitted the appropriate documentation. What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

Correct Answer:

Verified

The country club dues are not...

The country club dues are not...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: In-home office expenses are deductible if the

Q31: In-home office expenses which are not deductible

Q41: Gambling losses are miscellaneous itemized deductions subject

Q50: In which of the following situations is

Q63: Martin Corporation granted a nonqualified stock option

Q81: During 2014,Marcia,who is single and is covered

Q97: Matt is a sales representative for a

Q108: Martin Corporation granted an incentive stock option

Q111: Self-employed individuals receive a for AGI deduction

Q116: David acquired an automobile for $30,000 for