Multiple Choice

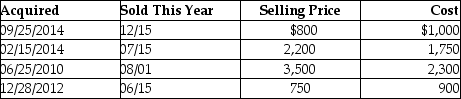

This year, Lauren sold several shares of stock held for investment. The following is a summary of her capital transactions for 2014:  What are the amounts of Lauren's capital gains (losses) for this year?

What are the amounts of Lauren's capital gains (losses) for this year?

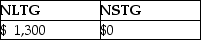

A)

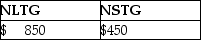

B)

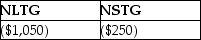

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Olivia,a single taxpayer,has AGI of $280,000 which

Q10: For purposes of calculating depreciation,property converted from

Q18: All recognized gains and losses must eventually

Q49: Josh purchases a personal residence for $278,000

Q52: Candice owns a mutual fund that reinvests

Q78: Kathleen received land as a gift from

Q84: David gave property with a basis of

Q91: Generally,gains resulting from the sale of collectibles

Q133: DeMarcus and Brianna are married and live

Q2205: What are arguments for and against preferential