Multiple Choice

Gertie has a NSTCL of $9,000 and a NLTCG of $5,500 during the current taxable year. After gains and losses are offset, Gertie reports

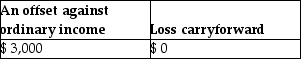

A)

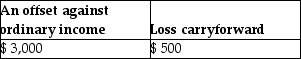

B)

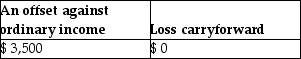

C)

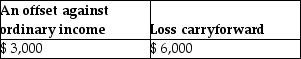

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q9: Allison buys equipment and pays cash of

Q34: Bob owns 100 shares of ACT Corporation

Q36: On January 31 of this year,Mallory pays

Q38: All of the following are capital assets

Q80: Kathleen received land as a gift from

Q95: Galvin Corporation has owned all of the

Q100: Edward purchased stock last year as follows:

Q108: On January 1 of this year,Brad purchased

Q115: Gain on sale of a patent by

Q751: What type of property should be transferred