Multiple Choice

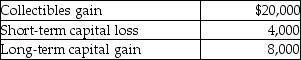

Kendrick, who has a 35% marginal tax rate, had the following results from transactions during the year:  After offsetting the STCL, what is (are) the resulting gain(s) ?

After offsetting the STCL, what is (are) the resulting gain(s) ?

A) $16,000 collectibles gain, $8,000 LTCG

B) $20,000 collectibles gain, $4,000 LTCG

C) $24,000 LTCG

D) $20,000 collectibles gain, $8,000 LTCG

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Stock purchased on December 15,2013,which becomes worthless

Q47: Dustin purchased 50 shares of Short Corporation

Q53: If Houston Printing Co.purchases a new printing

Q55: Antonio is single and has taxable income

Q62: Section 1221 specifically states that inventory or

Q69: A nonbusiness bad debt is deductible only

Q70: Kate subdivides land held as an investment

Q102: Gains and losses are recognized when property

Q107: Sari is single and has taxable income

Q1861: Donald has retired from his job as