Multiple Choice

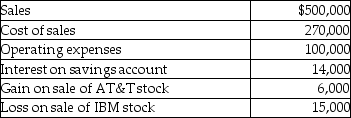

In the current year, ABC Corporation had the following items of income, expense, gains, and losses:  What is taxable income for the year?

What is taxable income for the year?

A) $135,000

B) $141,000

C) $144,000

D) $150,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q15: The taxable portion of a gain from

Q16: Taxpayers who own mutual funds recognize their

Q29: Amanda,whose tax rate is 33%,has NSTCL of

Q47: On July 25,2013,Karen gives stock with a

Q90: In a common law state,jointly owned property

Q103: If the taxpayer's net long-term capital losses

Q112: Section 1221 of the Code includes a

Q124: Expenditures which do not add to the

Q130: Net long-term capital gains receive preferential tax

Q2127: Distinguish between the Corn Products doctrine and