Multiple Choice

Rita, who has marginal tax rate of 39.6%, is planning to make a gift to her grandson who is in the lowest tax bracket. Which of the following holdings of stock would be the most tax advantageous gift from Rita's perspective?

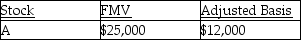

A)

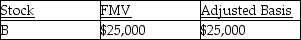

B)

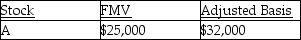

C)

D) For income tax purposes, Rita will be indifferent as to choice of stock to gift.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Funds borrowed and used to pay for

Q33: In 2011 Toni purchased 100 shares of

Q41: Douglas and Julie are a married couple

Q59: A building used in a trade or

Q87: Michelle purchased her home for $150,000,and subsequently

Q90: Capitalization of interest is required if debt

Q91: How long must a capital asset be

Q100: If stock sold or exchanged is not

Q116: Andrea died with an unused capital loss

Q130: In the current year,Andrew received a gift