Essay

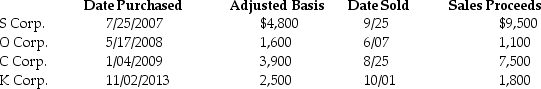

Mike sold the following shares of stock in 2014:

What are the tax consequences of these transactions, assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

What are the tax consequences of these transactions, assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q9: Which one of the following does not

Q20: Billy and Sue are married and live

Q27: Max sold the following capital assets this

Q33: Coretta sold the following securities during 2014:

Q35: If a nontaxable stock dividend is received

Q39: Rick sells stock of Ty Corporation,which has

Q43: Monte inherited 1,000 shares of Corporation Zero

Q49: Gina owns 100 shares of XYZ common

Q75: Jack exchanged land with an adjusted basis

Q135: Corporate taxpayers may offset capital losses only