Multiple Choice

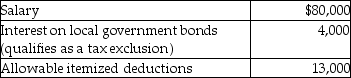

A single taxpayer provided the following information for 2014:  What is taxable income?

What is taxable income?

A) $57,050

B) $63,050

C) $63,000

D) $67,050

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: For 2014,unearned income in excess of $2,000

Q3: Kate is single and a homeowner.In 2014,she

Q15: Michelle,age 20,is a full-time college student with

Q28: In 2014 Carol and Robert have salaries

Q31: Eliza Smith's father,Victor,lives with Eliza who is

Q45: A married couple in the top tax

Q46: Although exclusions are usually not reported on

Q89: Julia provides more than 50 percent of

Q133: Charishma is a taxpayer with taxable income

Q418: Alexis and Terry have been married five