Multiple Choice

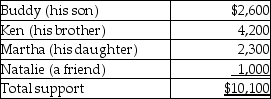

Blaine Greer lives alone. His support comes from the following sources:  Assuming a multiple support declaration exists, which of the individuals may claim Blaine as a dependent?

Assuming a multiple support declaration exists, which of the individuals may claim Blaine as a dependent?

A) Ken or Martha

B) Buddy, Ken, or Martha

C) Ken, Martha, or Natalie

D) None of them

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Which of the following types of itemized

Q26: Elise,age 20,is a full-time college student with

Q67: Kelsey is a cash-basis,calendar-year taxpayer.Her salary is

Q70: Amber supports four individuals: Erin,her stepdaughter,who lives

Q78: A widow or widower may file a

Q87: Tom and Alice were married on December

Q91: All of the following items are generally

Q102: All of the following items are deductions

Q107: A married taxpayer may file as head

Q715: Discuss reasons why a married couple may