Essay

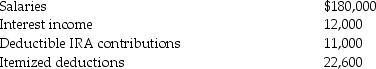

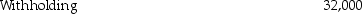

The following information is available for Bob and Brenda Horton, a married couple filing a joint return, for 2014. Both Bob and Brenda are age 32 and have no dependents.

a. What is the amount of their gross income?

a. What is the amount of their gross income?

b. What is the amount of their adjusted gross income?

c. What is the amount of their taxable income?

d. What is the amount of their tax liability (gross tax)?

e. What is the amount of their tax due or (refund due)?

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Married couples will normally file jointly.Identify a

Q90: Suri,age 8,is a dependent of her parents

Q101: A qualifying child of the taxpayer must

Q102: The standard deduction is the maximum amount

Q107: Shane and Alyssa (a married couple)have AGI

Q113: Brett,a single taxpayer with no dependents,earns salary

Q115: All of the following items are deductions

Q125: Paul and Hannah,who are married and file

Q126: Maxine,who is 76 years old and single,is

Q130: Ray is starting a new business and