Essay

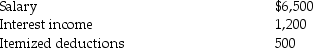

The following information for 2014 relates to Emma Grace, a single taxpayer, age 18:

a. Compute Emma Grace's taxable income assuming she is self-supporting.

a. Compute Emma Grace's taxable income assuming she is self-supporting.

b. Compute Emma Grace's taxable income assuming she is a dependent of her parents.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q20: Which of the following is not considered

Q30: One requirement for claiming a dependent other

Q55: Lewis,who is single,is claimed as a dependent

Q62: Lester,a widower qualifying as a surviving spouse,has

Q74: You may choose married filing jointly as

Q89: Julia provides more than 50 percent of

Q100: Indicate for each of the following the

Q418: Alexis and Terry have been married five

Q824: Discuss why Congress passed the innocent spouse

Q1436: Mary Ann pays the costs for her