Multiple Choice

Joey and Bob each have 50% interest in a Partnership. Both Joey and the partnership file returns on a calendar year basis. Partnership Q had a $12,000 loss in 2014. Joey's adjusted basis in his partnership interest on January 1, 2014 was $5,000. In 2015, the partnership had a profit of $10,000. Assuming there were no other adjustments to Joey's basis in the partnership, what amount of partnership income (loss) should Joey show on his 2014 and 2015 individual income tax returns?

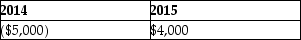

A)

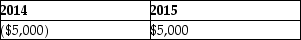

B)

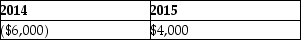

C)

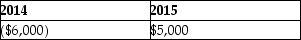

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q22: New business owners expecting losses in the

Q25: Which of the following statements is correct,

Q28: If partners having a majority interest in

Q29: An S corporation distributes land with a

Q31: At the beginning of this year, Edmond

Q38: Guaranteed payments are not deductible by the

Q51: An S corporation may not have more

Q56: All of the following are requirements to

Q78: Pass-through entities are taxed at only one

Q1172: Discuss the concept of partnership guaranteed payments.