Multiple Choice

Sandy and Larry each have a 50% interest in SL Partnership. The partnership and the individuals file on a calendar year basis. In 2014, SL Partnership had a $30,000 ordinary loss. Sandy's adjusted basis in her partnership interest on January 1, 2014 was $12,000. In 2015, SL Partnership had ordinary income of $20,000. Assuming there were no other adjustments to Sandy's basis in the partnership, what amount of partnership income (loss) would Sandy show on her 2014 and 2015 individual income tax returns?

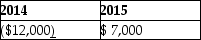

A)

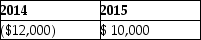

B)

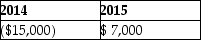

C)

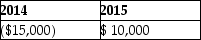

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Gains on sales or exchanges between a

Q13: A partnership sells equipment and recognizes depreciation

Q57: Under the "check-the-box" Treasury Regulations,an LLC with

Q66: Assuming extensions are not filed,tax returns for

Q98: An S corporation distributes land to its

Q119: All of the following could file partnership

Q132: Torrie and Laura form a partnership in

Q138: Lance transferred land having a $180,000 FMV

Q139: The basis of a partnership interest is

Q1594: Discuss how the partnership form of organization