Multiple Choice

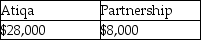

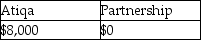

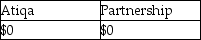

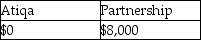

Atiqa receives a nonliquidating distribution of land from her partnership. The partnership purchased the land five years ago for $20,000. At the time of the distribution, it is worth $28,000. Prior to the distribution, Atiqa's basis in her partnership interest is $37,000. Due to the distribution Atiqa and the partnership will recognize income of

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Losses are disallowed on sales or exchanges

Q19: The partnership's assumption of a liability from

Q23: Voluntary revocation of an S corporation election

Q74: Bryan Corporation, an S corporation since its

Q78: Tonya is the 100% shareholder of a

Q103: An S corporation can have both voting

Q111: If a partner contributes property to a

Q135: A nonliquidating distribution of cash or property

Q1487: What are special allocations of partnership items

Q1746: What is the primary purpose of Form