Multiple Choice

Ariel receives from her partnership a nonliquidating distribution of $9,000 cash plus a parcel of land. The partnership had purchased the land five years ago for $20,000, but it is worth $28,000 at the time of the distribution. Ariel's predistribution basis is $17,000. How much income will Ariel recognize due to the distribution, and what is her basis in the land?

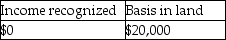

A)

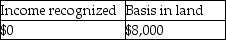

B)

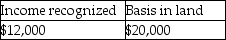

C)

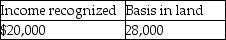

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q9: A contribution of services to a partnership

Q106: The transfer of property to a partnership

Q107: Members of a single family may be

Q115: Marisa has a 75% interest in the

Q117: On January 1 of this year (assume

Q117: David and Joycelyn form an equal partnership

Q120: Which of the following characteristics can disqualify

Q121: Dori and Matt will be equal owners

Q123: Atiqa receives a nonliquidating distribution of land

Q134: On July 1,Alexandra contributes business equipment (which