Essay

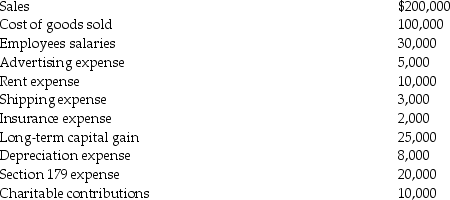

Longhorn Partnership reports the following items at the end of the current year:

What is the partnership's ordinary income? Which items are separately-stated?

What is the partnership's ordinary income? Which items are separately-stated?

Correct Answer:

Verified

Less:

Less:

S...

S...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q2: In a limited partnership,the limited partners are

Q24: A shareholder's basis for the S corporation

Q35: Because a partnership is a pass-through entity

Q46: Chen contributes a building worth $160,000 (adjusted

Q52: The income of a single member LLC

Q62: In 2014, Phuong transferred land having a

Q67: Raina owns 100% of Tribo Inc., an

Q74: An LLC that elects to be taxed

Q81: All costs of organizing a partnership can

Q138: Gain is recognized by an S corporation