Essay

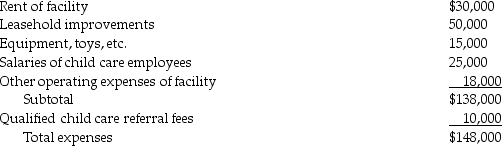

Hawaii, Inc., began a child care facility for its employees during the year. The corporation incurred the following expenses:

What is the amount of Hawaii's credit for employer-provided child care?

What is the amount of Hawaii's credit for employer-provided child care?

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q28: Which one of the following is a

Q38: Suzanne,a single taxpayer,has the following tax information

Q45: Rex has the following AMT adjustments: -Depreciation

Q57: Medical expenses in excess of 10% of

Q68: Runway Corporation has $2 million of gross

Q89: A taxpayer will be ineligible for the

Q96: Qualified tuition and related expenses eligible for

Q113: Kerry is single and has AGI of

Q115: In 2014 Charlton and Cindy have alternative

Q122: Refundable tax credits<br>A)only offset a taxpayer's tax